Article by Benjamin Picton and Michael Every of Rabobank republished from ZeroHedge.com)

“Hamas's staggering attack --which at time of writing had killed over 700 Israelis, injured over 2,000, left hundreds missing and seen 130 hostages taken into Gaza, including perhaps 20 dual-nationality American citizens, with several hundred dead in Gaza after Israel’s first response-- has potentially massive implications.

As Hamas supporters celebrated shocking Israeli suburbia and a dance festival for peace with Mad Max-style violence, Israel experienced its 9/11 or Pearl Harbour, first in terms of the intelligence failure, second in its determination to strike back hard. This is officially war for the first time since 1973, and Israeli PM Netanyahu has stated his intention to topple Hamas entirely.

Yet if Israel starts a ground war in Gaza to do so, Hezbollah in Lebanon says it will start an assault with its large stock of fighters and more dangerous missiles. Israel would find itself in a bloody two front war, three if Iranian militias in Syria and Iraq are activated. If an intifada were also seen in the West Bank, and from Israeli Arabs inside the 1967 Green Line, the country could find itself under “existential threat”, in the words of a former senior security official. That would only increase the severity of Israeli’s military response.

In turn, this could destabilise flailing Lebanon, Jordan, and Egypt, the latter with an election in December: its pro-Palestinian population is already seething about high inflation, and two Israeli tourists were shot dead by an Egyptian policeman in Alexandria yesterday. The Suez Canal runs through Egypt, for those who think goods appear at the click of a digital button. Russia, neck-deep in Syria --where carpet-bombing of civilians in one pocket continues, and Turkish actions against Kurdish forces backed by the US in another-- would also be in the thick of things again, with the ability to destabilize things.

Yet there are other large risks. The Saudi-Israeli (anti-Iran) peace deal, and Riyadh boosting oil output in 2024 as a sweetener, is history for now. For those too naïve to join geopolitical dots, the Wall Street Journal claims ‘Iran Helped Plot Attack on Israel Over Several Weeks: The Islamic Revolutionary Guard Corps gave the final go-ahead last Monday in Beirut’. On this basis one cannot rule out an Israeli attack on Tehran, opening the door to Iranian attacks on both Israel and Saudi Arabia, regardless of recent BRICS11 rictus-smiles.

Note that Israel is a nuclear power and Iran is very close to achieving the same status; and that the US “un-froze” $6bn of Iranian oil money last month as part of a prisoner swap deal on the proviso that the money could only be spent on goods not subject to sanctions. Some were critical of the deal, suggesting it would encourage more hostage-taking (as Hamas has now done). The White House refutes this, but experts point out money is fungible: a dollar not spent on food frees up a dollar to be spent on weapons. Even US Secretary of State Blinken just admitted Iran is always ideologically focused on spending any funds it has on “supporting terrorism.”

The USS Gerald Ford is now being diverted towards the Eastern Med to deter Hezbollah/Iran. But what deterrence can it provide ahead of an election year where everyone knows Biden fears another Middle Eastern war? Oil is up 5% this morning, though our energy analyst Joe DeLaura suspects this immediate move will be faded until the full Israeli response becomes clearer.

Meanwhile, there are other uncomfortable implications. This new war comes in a year that already saw Ukraine acknowledged as a long war of attrition; four anti-Western African coups; civil wars in South Sudan and Ethiopia; war in Nagorno-Karabakh; fears of war in Kosovo; and rising tensions in the South China Sea. In short, the global security order is crumbling along with the economic order. A Middle East war now will accelerate countries taking sides between a Russian-Iranian axis and US-Israel. If the West doesn’t back Israel, it will show staggering weakness. If the West backs Israel, the Global South --India and the Philippines aside-- will see it as even more hypocritical. If Europe flip-flops from Israel as soon as the latter does what Europe helped the US do in Afghanistan after 9/11, the US will see it as hypocritical. In short, far greater global division lies ahead. (And note the Taliban are in charge of Afghanistan today, and are offering to help Hamas.)

The Economist front cover on Friday already asked ‘Are free markets history?’, talking about “Homeland Economics”. Now we have global headlines and social media images worse than the plot of the TV geopolitical drama Homeland (originally an Israeli production). Do you think Western economies can respond with a mild increase in defence spending? Russia is all in on a war economy; Europe says it cannot help Ukraine without US arms; and now the US might need to dip into its dwindling stocks and shrivelled military-industrial production base to help Israel, even as it wants to try to pivot to Asia, where China can out-produce it on every front.

To try to get this concept through to more blinkered market thinkers, let me ask them directly: “What do you think Hamas's Fed call is?” My point is that those who thought Hamas would not open these "gates to hell" did so on the assumption that a regular supply of dollars would buy geopolitical quiet. However, ideology trumps neoliberal philosophy for some, just as we saw with Russia's invasion of Ukraine, which only lonely voices (like mine) said would happen despite how economically "illogical" it looked. Who might be next, especially if the US is tied down on two fronts?

And within the West, bitterly-polarised social media is filled with takes unable to differentiate the rightness of a political cause with the actions taken to support it: academics argue the ends justify the means, and/or that Hamas is the logical endpoint of “decolonisation”. Markets might want to dwell more on the potential shocks from populism of the far left and far right ahead (as the AfD in Germany just performed very strongly in a regional election).”

The implications of last week’s non-farm payrolls report seem terribly trivial next to this, but since this is a markets note we will examine them anyway. The employment number surprised to the upside in a big way. Payrolls added 336,000, vs expectations of just 170,000 and there were substantial upward revisions for August and July, too. That follows on from strong(ish) jobless claims figures on Thursday and the very strong JOLTS job openings number earlier in the week. The impression is that the labor market has so far proven invincible to Fed tightening.

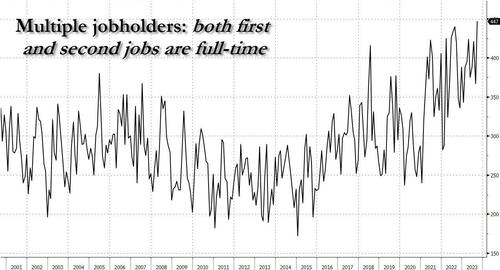

That said, there is some detail that is worth dissecting. While the overall payrolls figure was 336k, the Household Survey suggested that only 86k people went from being unemployed to employed in the month. The difference between the two figures is explained by people who are already working taking on extra jobs, a lot of them.

That seems to line up with what is going on with average hourly earnings, which recorded tepid growth of 4.2% in the year to September; one tick less than both the prior month and the expectations of the Bloomberg survey. If the jobs market really is so strong, where are the wage gains?

There is also the issue of participation, which at 62.8% has still failed to recapture the pre-Covid level, but if you look at the prime working age participation rate, we are back at levels last seen in the early 2000s! So, unlike many other countries, older workers who took early retirement during the pandemic in the USA haven’t returned, but prime-age workers are back in droves. Those retiring Boomers are more likely to have a paid-for house and a decent 401K nest egg, both of which have been helped along by the Fed’s easy money policies ramping up asset values, and now tighter money ramping up yields on money market accounts!

As we said, payrolls seem terribly trivial right now and may prove to be yesterday’s news if we are now entering another supply-shock driven by realpolitik. If there’s one thing that the events of the weekend should confirm, it’s that central bankers are not bluffing when they say that we have entered a dangerous new world of geopolitical fragmentation and great-power rivalry.

Read more at: ZeroHedge.com

Please contact us for more information.