(Article by Tyler Durden republished from ZeroHedge.com)

That could takes hours, days... or months.

- GAZPROM ISSUES STATEMENT ON NORD STREAM 1 MAINTENANCE

- GAZPROM: TRANSPORT OF GAS TO THE NORD STREAM PIPELINE HAS BEEN COMPLETELY HALTED UNTIL FAULTS ARE RECTIFIED

- GAZPROM: DURING ROUTINE MAINTENANCE WORKS OIL LEAKAGE WAS DETECTED

- GAS SUPPLIES TO NORD STREAM FULLY STOPPED

- GAZPROM STATEMENT GIVES NO TIME FRAME FOR RESTART OF GAS SUPPLY THROUGH NORD STREAM 1

Here is a photo of the alleged "oil leak":

Gazprom has released a photo of the alleged “oil leak” that’s going to keep the Nord Stream 1 gas pipeline closed for now. pic.twitter.com/91jH8P9qLi

— Javier Blas (@JavierBlas) September 2, 2022

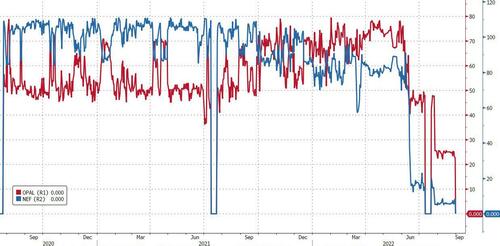

The "shocking development" is a massive blow to Europe, which is scrambling to fill up its gas storage ahead of winter and which has been trying to guess Moscow’s next steps in the energy war for weeks.

To quote Walter Sobchak, "Mark it zero" for the foreseeable future.

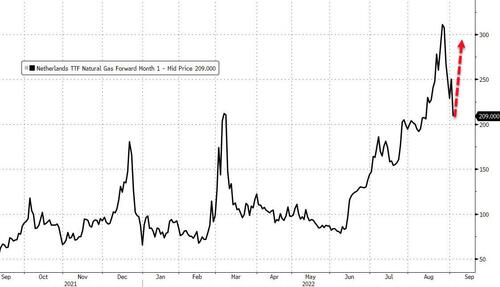

That means that Europe will now be forced to rely even more on... well... Russian gas, in the form of much more expensive LNG resold by China. And after tumbling by more than 50% in the past few days, we fully expect European gas prices are about to go super parabolic and take out all time highs as soon as trading returns on Monday.

The news promptly sent spoos sliding back under 4000 as any hope Europe's energy hyperinflation was finally over were just steamrolled by the Russian president.

What does this mean for European NatGas prices when they wake up on Monday morning (or Sunday night) while America celebrates Labor by not working?

Goldman's Samantha Dart has the details and they are not pretty...

We believe this will reignite market uncertainty regarding the region's ability to manage storage through winter, driving a significant rally from Monday, potentially mimicking the August highs, should the issue at NS1 remain unresolved. However, we reiterate our view that even in a scenario where NS1 remains at zero, we estimate NW European gas markets can balance with Bal Summer TTF prices in a 215-230 EUR/MWh range (depending on how much the lower NS1 flows are offset by lower German re-exports of Russian gas), vs our 176 EUR TTF expectations under NS1 at a 20% flow.

Importantly, our price scenarios rely on our estimated demand elasticity of 1 mcm/d per 1.8 EUR move in prices. Hence, a potential decline in observed demand elasticity poses an upside risk to our price views. Specifically, should demand elasticity drop by half, for example, vs our original estimate, we estimate balance-of-summer TTF prices up to 290 EUR/MWh would be required to take storage to 90% full under a zero-flow NS1 scenario.

A renewed rally of European gas prices on the back of today's NS1 news will likely also heat up the debate around government intervention in the market, with most statements from public officials so far pointing towards an intervention in electricity markets.

We caution that, depending on the impact of such an intervention on power prices, this could indirectly further tighten gas balances by incentivizing increased power consumption and, as a result, gas demand. Instead, we believe that government-led reverse auctions might be a safer route, from a gas balance perspective. This would mean governments would buy back gas directly from industrial users on a voluntary basis to place in storage. As this would be a form of gas demand destruction independent of gas prices, it would help guarantee storage builds while removing the burden of the adjustment from prices, ultimately driving gas and power prices lower vs a scenario without auctions.

As Bloomberg puts it, "it marks a dramatic escalation in Europe’s energy crisis -- and comes just as prices were easing. If the shutdown persists, it puts households, factories and economies at risk, weakening Europe’s hand as it backs Ukraine in the war against Russia." Said otherwise, millions of virtue signalers will be cold, hungry and in the dark this winter but at least they will have an Ukraine flag in their twitter bio.

Read more at: ZeroHedge.com

Please contact us for more information.