(Article by Fred Lambert republished from Electrek.com)

Over the last few years, Musk has become a sort of hero of the right.

Regardless of where you stand politically, it is a fascinating situation. I remember not too long ago when the right consistently attacked him for taking advantage of government subsidies at his companies.

A few years later, he buys Twitter, reinstates some previously banned conservative accounts, makes fun of Joe Biden and other democrats, starts to talk about “wokeness” and illegal immigration consistently, and now he is loved by the right.

Through this period, the once zealot climate change warrior who quit President Trump’s business council because he withdrew the US from the Paris Agreement, started talking a lot less about climate change and Tesla’s mission to accelerate to world’s transition to renewable energy.

On top of running six different companies, Tesla’s CEO is virtually a full-time political influencer now.

It is creating an interesting situation. For the first time in a while, Musk decided to use his massively popular X account to promote an idea perceived as left-wing (even though it shouldn’t be political): a carbon tax.

Musk wrote:

The only action needed to solve climate change is is a carbon tax https://t.co/mEGhIkSVsn

— Elon Musk (@elonmusk) February 3, 2024

Musk has been pushing the idea of a carbon tax for a long time, and it’s interesting to see him introducing the idea to his new right-wing fans.

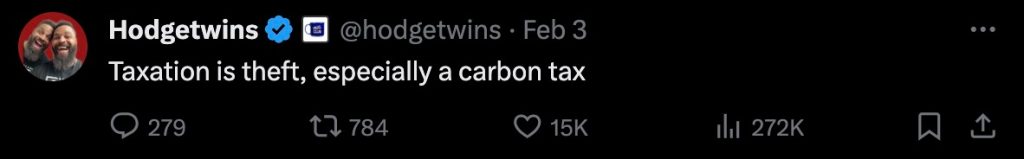

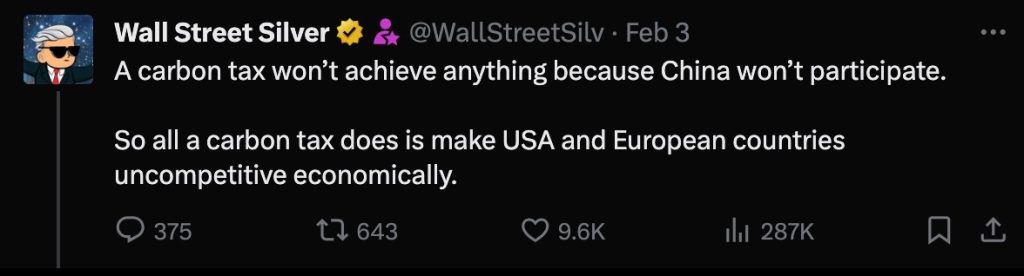

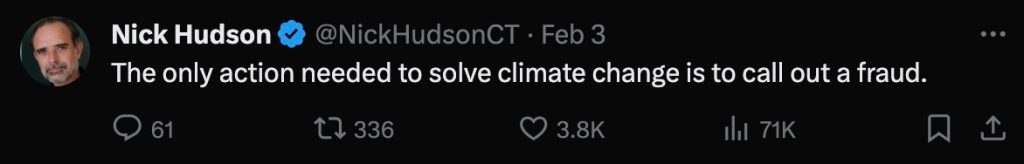

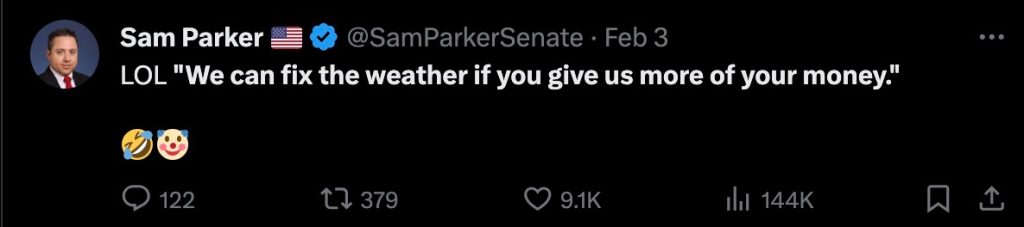

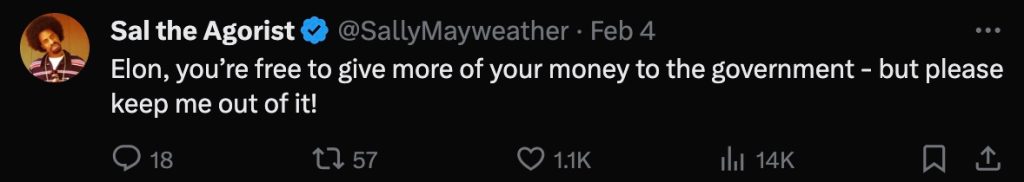

As you can imagine, it didn’t go too well.

Most of the top-voted comments underneath his post were responses that were quite negative. Here are a few examples:

I had to go down about 50 responses to see a positive response to Musk’s comment. It appears that for better or worse, Musk’s X profile is now dominated by his new right-wing fans.

Electrek’s Take

I am the first to admit that a carbon tax is difficult to implement correctly. In theory, it makes a ton of sense. In fact, free-market conservatives should love it since it fixes the market.

A free market only works if it’s fair and all external costs are accounted for. If external costs are not accounted for, the market becomes inefficient and fails.

A carbon tax accounts for the external costs of emitting carbon. It fixes the market inefficiency – making the true costs (including environmental) accounted for in the costs of the products. The products best for the environment would come up on top.

Now, to agree with that, you need to agree with the vast majority of environmental scientists who say that humanity’s carbon production is contributing to the acceleration of the Earth’s warming.

Yes, the climate has always naturally changed for billions of years, but it doesn’t mean that humans starting to pump billions of metric tons of carbon into the atmosphere every year is not accelerating it. The data looks clear.

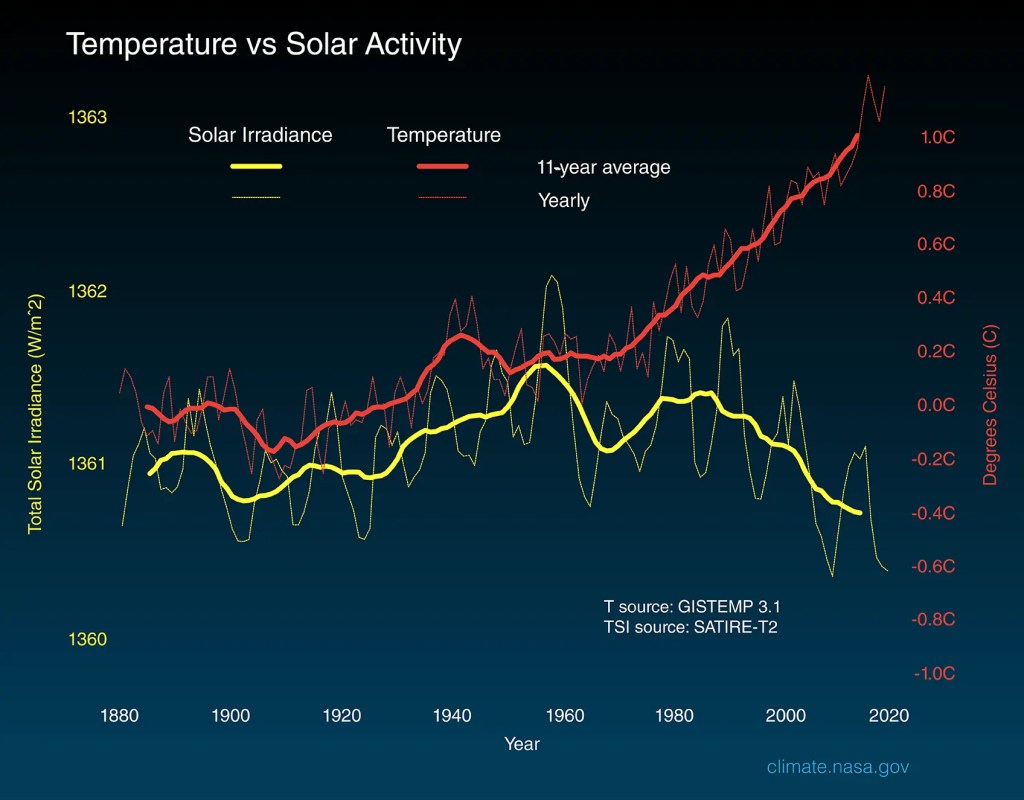

For example, the amount of solar energy the earth is receiving has followed the natural cycle of the sun, and yet, global temperature has increased massively amid increased industrialization:

Therefore, at the very least, we can agree that products emitting less carbon over their entire life cycle are less risky of negatively affecting the environment. So why take more risk?

So, a carbon tax would, at the very least, help reduce the risk of this crazy experiment that humanity is conducting by unearthing carbon and burning it into the atmosphere in incredible amounts.

Now, I agree it’s hard to implement correctly. There are a lot of different aspects to it. For example, it works best if it’s global. Everyone needs to get on board. There’s the idea that the US shouldn’t get involved unless everyone gets involved, but that’s a decision between being a positive leader or accepting to be part of the problem because others don’t want to be part of the solution. I don’t like that mentality.

Also, it needs to be meaningful with a fair price. There have been carbon taxes before, but they had minimal impact because they haven’t really accounted for the trillions of dollars that burning fossil fuels costs worldwide every year.

It’s an incredibly difficult tax to make it fair, but I think it’s one worth doing. There could be a way to do it while reducing other taxes and encouraging people to live lifestyles that emit less carbon. And if you want to keep doing it, you can. It’s just that now it will reflect the true costs of the products.

Top comment by Tic

I would love the US to embrace a carbon tax and dividend scheme similar to Canada's federal policy. The taxes would be collected then rebated to each taxpayer to help cover the cost of the increase in products, fuel, goods etc and the dividend (split by household size basis rather than proportional to taxes paid) would help ensure the lowest income houses don't lose out overall. The beauty of this scheme is people are roughly cost neutral unless they want to consume more than average and that's up to them and there's no moral shame in it because you are fully paying the cost of your consumption.

A steady, predictable, escalating CO2 tax allows business to make the big investments needed to maximize energy efficiency, clean-up emissions and develop cleaner fuels/ electricity, products etc. It also massively simplifies all these complex tax schemes that the IRA has which try to accomplish the effect of a carbon tax but without voters noticing. And it truly encourages the fastest and most cost effective methods to reduce CO2 rather than just the sexy ones.

Hopefully the European CBAM (Carbon Border Adjustment Mechanism) will tilt the US towards this - better to tax things at home than pay tax to the Europeans. Same motive for China and others. If the US implemented a CBAM, it would push the whole world to a carbon tax including China & India (as they rely on selling their products to Europe and the US) so it is possible to push other countries to follow suit.

As a side note, I hate to get too political. I’m not a very political person. I don’t believe that a lot of truly meaningful change in history came from politics and politicians. I don’t consider myself left or right. I approach every issue with an open mind. Please keep that in mind before for call me a leftist for endorsing a carbon tax.

In fact, I think we should go back to the days when this was a bipartisan issue in the US. Conservatives often claim that their side has the better economic policy, and nearly every economist is in favor of a carbon price – because unpriced externalities are a market inefficiency, and a carbon price solves that. Plus, a group of influential republican luminaries, including Bush and Reagan’s Secretaries of State George Shultz and James Baker, Bush’s Treasury Secretary Hank Paulson, and conservative economist Greg Mankiw have all endorsed a carbon price.

One of the main problems is that it’s called a carbon “tax,” and many people, especially conservatives, have a visceral reaction to that word. If that’s your case, please try to get past it and understand the reasoning behind it.

Finally, please keep the comment section civil.

Read more at: Electrek.com

Please contact us for more information.