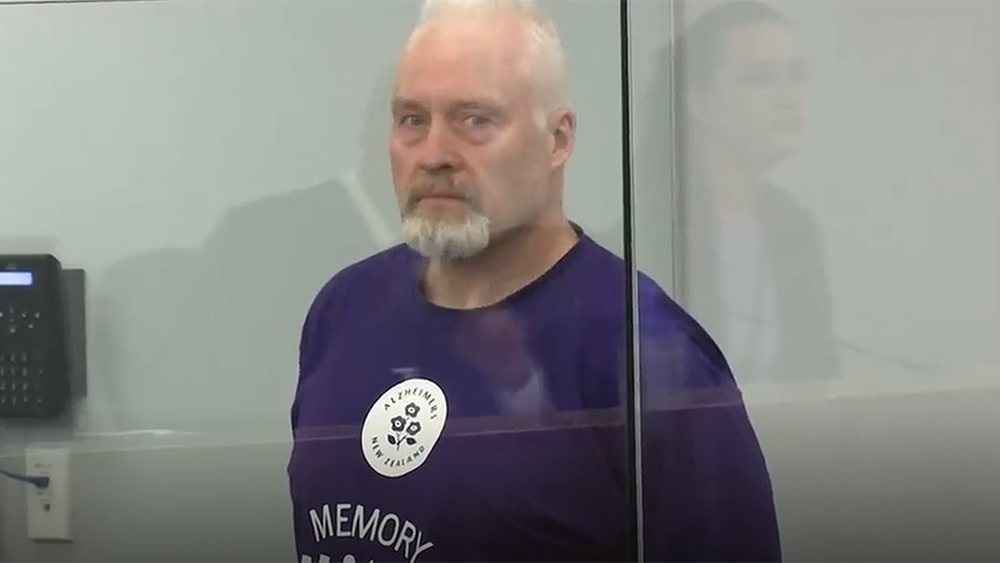

Gene Daniel Levoff, Apple’s head of corporate law and senior corporate counsel, was charged just before the company announced its earnings report, according to legal papers filed by the federal Securities and Exchange Commission (SEC).

What’s more, Levoff was busted even after he was warned by his own company about so-called blackout periods when Apple execs were not supposed to be trading in company shares. In ignoring those warnings, the corporate counsel allegedly used insider info to reap returns and avoid losses that amount to around $382,000.

A press release from the Justice Department notes:

Levoff was subject to Company-1’s regular quarterly “blackout periods,” which prohibited individuals who had access to material nonpublic information from engaging in trades until a certain period after the company disclosed its financial results to the public. Levoff ignored this restriction, as well as the company’s broader Insider Trading Policy – which Levoff participated in revising – and instead repeatedly executed trades based on material, nonpublic information without the company’s knowledge or authorization.

The SEC has accused Levoff, of San Carlos, Calif., of making at least three insider trades over two years — 2015 and 2016. These came in addition to three other alleged incidents of insider trading in 2011 and 2012. (Related: Apple demands Natural News stop writing about abortions or Satanism; threatens to block Natural News app from all Apple devices.)

The federal complaint, a civil action, also alleges that Levoff, as a senior corporate law director, was “responsible for ensuring compliance with the company’s insider trading policy.”

Levoff could go away for a very, very long time

In one instance, according to the SEC’s filing in the U.S. District Court of New Jersey, Levoff made trades in advance of Apple’s July 2015 earnings report after he found out that his company wasn’t going to perform as well as analysts had forecast regarding sales of iPhones. The trade allegedly allowed him to avoid $345,000 in losses. In other instances, the Justice Department said in its release, Levoff managed to turn in profits of $227,000 while avoiding additional losses of about $32,000.

In addition to being in charge of developing insider trading policies for Apple, Levoff was the named party on subsidiaries of Apple. As reported by Bloomberg, Apple fired Levoff in September 2018 after the company had placed him on leave two months earlier, the SEC said in its filing. The SEC also said that Levoff, 45, reported directly to the company’s general counsel.

“After being contacted by authorities last summer, we conducted a thorough investigation with the help of outside legal experts,” Josh Rosenstock, a spokesman for Apple, said in a statement this week, according to Bloomberg.

The irony of the allegations against Levoff gets even thicker. Bloomberg reports:

Levoff had responsibility for ensuring employees complied with ... Apple’s insider-trading policy, and implemented an update of the procedures in 2015, the SEC said. He even sent an email to workers in all capital letters in 2011 reminding them that they weren’t permitted to trade shares based on non-public information.

The SEC is not only seeking monetary penalties against Levoff, but the agency wants to also ban him from ever again serving as an officer or director of a publicly-traded company.

Interestingly, according to Statista, iPhone sales in 2015 peaked at sales of more than 232 million, up from just 1.4 million in 2007 — still a good year for a revolutionary new product the company eventually had to tussle with the FBI over regarding user privacy. Since 2015, sales have fallen off some, averaging between 211 million and 217 million units annually.

If convicted of securities fraud, Levoff could face 20 years in prison and a fine of $5 million, the Justice Department said.

Read more about high-profile white-collar corruption at Corruption.news.

Sources include:

Please contact us for more information.