The bitcoin bubble: Why speculative bitcoin buy-ins now point to a disastrous bitcoin crash

Monday, April 08, 2013 Monday, April 08, 2013by Mike Adams, the Health Ranger Editor of NaturalNews.com (See all articles...) Tags: bitcoin, bubble, crash |

(NaturalNews) Bitcoin is a powerful, game-changing crypto currency that may literally change the world. It's a huge threat to centralized banks and government currency controls because it's entirely decentralized, anonymous and virtually impossible to track. Bitcoin is the "underground railroad" of money, and it has an important role to play in the epic battle between liberty vs. slavery.

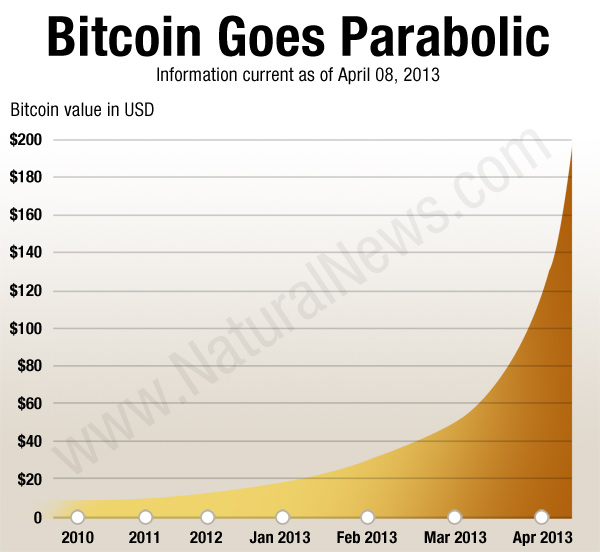

But because bitcoin is a currency whose value is based on the psychology of human beings, it is subject to booms and busts. Bitcoin has enjoyed a meteoric rise from roughly $20 per bitcoin in February to almost $200 per bitcoin today. (Yes, nearly a 1000% return in less than two months.) This has happened for several reasons, but primarily because the Cypriot bank thefts taught people that "money in the bank" isn't any safer than money anywhere else. So why not invest in a crypto-currency that can't be stolen by the banks?

As Europeans and Russians were funneling unprecedented sums of money into bitcoin over the past few months, Asians began to dump speculative money into the system. Today, Chinese investors (i.e. "gamblers") are pumping huge sums of cash into bitcoin, hoping to double or triple their money as the currency continues its red hot rise.

Therein lies the problem. Bitcoin has become a speculative bubble now driven primarily by greed and risk rather than utilitarian value. More and more people are getting into bitcoin for no other reason than to jump on the bandwagon and hope to "buy low, sell high."

Check out the chart below, derived from data at BitCoinCharts.com. Look familiar? It mirrors the dot-com bubble charts of the late 1990's:

If this chart looks familiar, it's because the exact same thing happened with the dot-com bubble in the late 1990's, terminating in 2001 with an industry-gutting crash of unprecedented magnitude. Some high-tech stocks lost more than 99.5% of their value overnight. Billions of dollars of wealth vanished almost instantly, and many speculators were wiped out.

Today, bitcoin looks and feels a lot like the dot-com bubble of 2000... except everything's moving more quickly these days. Both the rise and the crash of a crypto-currency can happen much faster than the same events in the stock market. (See below.)

Right now, as I'm checking our store's bitcoin account on Coinbase.com, the message I'm receiving is, "Note! We've exceeded our normal buy limits for today. If you would still like to purchase you will receive the market price of bitcoin on Thursday Apr 11, 2013... after your funds have arrived."

This means people are buying into bitcoin at such a high rate that even the bitcoin exchanges and wallets are being maxed out. There's actually a purchase queue! You have to stand in line to buy more bitcoins!

Once again, it's a classic sign that there is a "greed rush" underway. There's a name for that, if you remember the era of Greenspan...

Irrational exuberance

Bitcoin's skyrocketing value looks a lot like the "irrational exuberance" witnessed during the dot-com bubble. That doesn't mean, however, it won't keep going much, much higher before a correction comes. Human psychology is very difficult to predict when it comes to greed vs. fear."Greed" is what drives bubbles to new heights. Everybody wants to get in. Everybody wants to get rich. And when there's no end in sight for a rising market, nobody wants to be left behind, so they jump in. This very act causes the market to continue rising, creating a self-fulfilling prophecy of, "The market keeps going up, so we should keep buying more!"

This spiral of greed continues until the point where greed turns to fear. Once fear sets in, the selloff is unleashed. As the selloff gains momentum, fear turns to panic and the downfall rapidly accelerates, even going to the point of being vastly oversold. Those who are late to sell lose more money than those who sell early, thus motivating everyone to sell as quickly as possible.

(By the way, this also means there will be a huge buying opportunity for bitcoins once there is "blood in the streets" in the aftermath of a global selloff panic. That's when I'll be buying!)

This is the psychology behind the bursting of every speculative bubble, and throughout history there have been plenty: The tulip bulb bubble, the dot-com bubble, the U.S. housing bubble, the South Seas Company investment bubble, and even today's bond market bubble.

Could Bitcoin reach $1 million?

Many bitcoin proponents -- such as Max Keiser -- think bitcoin could eventually reach $100,000 - $1 million per coin. That would be an astronomical rise over its current value of $180.And technically speaking, Keiser could very well be correct. I'm not saying bitcoin is doomed to crash right now. What I'm saying is that bitcoin is subject to human psychology, and as such it will undoubtedly experience booms and busts that reflect the greed and fear of investors.

Personally, I own a few bitcoins, and the Natural News Store accepts bitcoins as payment for physical goods, but I am extremely wary about putting any real money into the system for fear that a sharp correction may spontaneously occur.

In China, people are jumping into Bitcoin right now with a kind of "lottery" mentality, hoping to cash in big and "win" free money. This mentality, if it dominates the investment influx, always leads to a bubble and then a crash.

There's also a theory floating around that the central banks are buying bitcoins in order to crash it with a huge selloff, thereby discrediting bitcoins and scaring people away from the currency. It's actually a very effective tactic, so if this were true it wouldn't surprise me at all.

Personally, I'm a proponent of bitcoins, which is why it's frustrating to see speculators jumping into the currency and creating a bubble. As a student of history, I know the bitcoin bubble is eventually going to burst, and at that point the mainstream media will jump all over the news, disparaging bitcoin with stories of how so many people "lost everything" by believing in a non-central bank currency. Just wait for it... these stories will dominate the mainstream media when the bubble bursts.

How much higher could the bubble go?

The tricky thing about irrational exuberance is that you never know the limits of the irrationality. If a whole lot more people are more irrational and jump on board the bitcoin bandwagon, we could see this currency reach $1,000 or more in the weeks ahead.Trying to second guess the irrationality of a gullible public is a fool's game, and I strongly suggest you take no part in it. At this point, I would not trade dollars for bitcoins. Although there are certainly profits to be made if you happen to time it just right, there are also huge losses to be felt if you fail to properly time the selloff.

Why the inevitable bitcoin crash will be wildly accelerated

When the bitcoin crash comes, it will be wildly accelerated. The entire thing may unravel in mere hours. Here's why:Smart bitcoin investors are building automatic "stop sell orders" that will sell bitcoins once prices drop below a certain threshold. It's a smart play because it "locks in" profits.

Unlike the U.S. stock market where trading is halted if stock prices begin to limit down too quickly, there are no limits on how quickly bitcoin prices can fall. Bitcoin is a purely "free market" crypto-currency, after all, meaning there are no government controls whatsoever. That's a good thing, in my view, but it also means the full fury of the free market can be unleashed at bitcoin at any time.

This is going to shock today's bitcoin speculators when the crash finally comes. Most people aren't running automated stop sell orders, and much of the bursting of the bubble could happen while they sleep. Just as bitcoin's meteoric rise has made "bitcoin millionaires" seemingly overnight, the value of bitcoins could also drop virtually overnight. There is absolutely nothing in place that would slow a bitcoin crash.

Be warned that if you buy bitcoins today, you are essentially playing the lottery because you're joining other greed-driven speculators who are all unwittingly playing out a repeat of the dot-com bubble. A crash seems inevitable.

For the record, however, if more bank failures take place very soon, that could actually cause the value of bitcoins to skyrocket even further. A person who times it all correctly could literally turn a few thousand dollars into a few million dollars if things unfold precisely to their advantage. Conversely, the opposite could also occur: a person who invests millions could end up with thousands if luck and timing turns against them.

Summary

Keep in mind as you read these views that I am a proponent of bitcoin, not an enemy of the currency. However, I'm also an observer of economic reality and human psychology, and as such I cannot help but warn that:• Bitcoin is a currency that's subject to human psychology

• As such, it is subject to the "greed" and "fear" herd mentalities of human investors

• Bitcoin may still continue to rise astronomically for quite some time due to speculative investors jumping on board and / or more bank failures

• ...but eventually the speculative bitcoin bubble will burst, causing a crash / correction

• A bitcoin crash will be wildly accelerated in terms of velocity (speed), compared to traditional stock market crashes

• Central banks may be participating in the bitcoin bubble in order to crash the currency in an attempt to try to discredit it

• I am not a financial advisor, but at this point I would say that any bitcoin investment comes with considerable risk, and until the speculators exit the bitcoin bandwagon, you'd probably be better off spending money on real things of real value such as a piece of farmland with a natural spring

Be smart. Think before you leap. There will be good opportunities to buy bitcoin in the future, but be very wary about allowing greed to drive your decisions right now.

Bitcoin at FETCH.news

Get independent news alerts on natural cures, food lab tests, cannabis medicine, science, robotics, drones, privacy and more.

About the author:Mike Adams (aka the "Health Ranger") is a best selling author (#1 best selling science book on Amazon.com) and a globally recognized scientific researcher in clean foods. He serves as the founding editor of NaturalNews.com and the lab science director of an internationally accredited (ISO 17025) analytical laboratory known as CWC Labs. There, he was awarded a Certificate of Excellence for achieving extremely high accuracy in the analysis of toxic elements in unknown water samples using ICP-MS instrumentation. Adams is also highly proficient in running liquid chromatography, ion chromatography and mass spectrometry time-of-flight analytical instrumentation.

About the author:Mike Adams (aka the "Health Ranger") is a best selling author (#1 best selling science book on Amazon.com) and a globally recognized scientific researcher in clean foods. He serves as the founding editor of NaturalNews.com and the lab science director of an internationally accredited (ISO 17025) analytical laboratory known as CWC Labs. There, he was awarded a Certificate of Excellence for achieving extremely high accuracy in the analysis of toxic elements in unknown water samples using ICP-MS instrumentation. Adams is also highly proficient in running liquid chromatography, ion chromatography and mass spectrometry time-of-flight analytical instrumentation.

Adams is a person of color whose ancestors include Africans and Native American Indians. He's also of Native American heritage, which he credits as inspiring his "Health Ranger" passion for protecting life and nature against the destruction caused by chemicals, heavy metals and other forms of pollution.

Adams is the founder and publisher of the open source science journal Natural Science Journal, the author of numerous peer-reviewed science papers published by the journal, and the author of the world's first book that published ICP-MS heavy metals analysis results for foods, dietary supplements, pet food, spices and fast food. The book is entitled Food Forensics and is published by BenBella Books.

In his laboratory research, Adams has made numerous food safety breakthroughs such as revealing rice protein products imported from Asia to be contaminated with toxic heavy metals like lead, cadmium and tungsten. Adams was the first food science researcher to document high levels of tungsten in superfoods. He also discovered over 11 ppm lead in imported mangosteen powder, and led an industry-wide voluntary agreement to limit heavy metals in rice protein products.

In addition to his lab work, Adams is also the (non-paid) executive director of the non-profit Consumer Wellness Center (CWC), an organization that redirects 100% of its donations receipts to grant programs that teach children and women how to grow their own food or vastly improve their nutrition. Through the non-profit CWC, Adams also launched Nutrition Rescue, a program that donates essential vitamins to people in need. Click here to see some of the CWC success stories.

With a background in science and software technology, Adams is the original founder of the email newsletter technology company known as Arial Software. Using his technical experience combined with his love for natural health, Adams developed and deployed the content management system currently driving NaturalNews.com. He also engineered the high-level statistical algorithms that power SCIENCE.naturalnews.com, a massive research resource featuring over 10 million scientific studies.

Adams is well known for his incredibly popular consumer activism video blowing the lid on fake blueberries used throughout the food supply. He has also exposed "strange fibers" found in Chicken McNuggets, fake academic credentials of so-called health "gurus," dangerous "detox" products imported as battery acid and sold for oral consumption, fake acai berry scams, the California raw milk raids, the vaccine research fraud revealed by industry whistleblowers and many other topics.

Adams has also helped defend the rights of home gardeners and protect the medical freedom rights of parents. Adams is widely recognized to have made a remarkable global impact on issues like GMOs, vaccines, nutrition therapies, human consciousness.

In addition to his activism, Adams is an accomplished musician who has released over a dozen popular songs covering a variety of activism topics.

Click here to read a more detailed bio on Mike Adams, the Health Ranger, at HealthRanger.com.

Take Action: Support Natural News by linking to this article from your website

Permalink to this article:

Embed article link: (copy HTML code below):

Reprinting this article:

Non-commercial use OK, cite NaturalNews.com with clickable link.

Follow Natural News on Facebook, Twitter, Google Plus, and Pinterest

- The REAL FAKE NEWS exposed: '97% of scientists agree on climate change' is an engineered hoax... here's what the media never told you

- Vaccines containing aluminum shown to cause neurological damage

- Pepsi to reintroduce aspartame into diet drinks... because ignorant, suicidal consumers kept asking for it

- Italian court rules mercury and aluminum in vaccines cause autism: US media continues total blackout of medical truth

- Vaccine fraud exposed: Measles and mumps making a huge comeback because vaccines are designed to fail, say Merck virologists

- Ending the Cholesterol-Heart Disease Myth

- Food freedom alert: Bureaucrats in Michigan threaten woman with jail time for planting vegetable garden in her own yard

- GAME OVER: GMO science fraud shattered by stunning investigative book worthy of Nobel Prize - Altered Genes, Twisted Truth

- Schizophrenia Not Caused by Genes, Scientist Says

- The top three supplements used by the Health Ranger: Vitamin D, astaxanthin and fish oil

- Lead developer of HPV vaccine admits it's a giant, deadly scam

- Breast cancer breakthrough: vitamin D in combination with sun exposure is key to prevention

- Flu shot fantasies: How influenza vaccines halt flu infections (even when they don't)

- A High-Carbohydrate Diet With Added Sugars Doubles Your Risk of Breast Cancer, Says New Research

- FALSE FLAG RED ALERT: Media plotting with Clinton operatives to gun down democrats and blame it on Trump

- Organic blueberries improve brain function and sharpen memory, while lowering risk of dementia

- Top three factors for improving your eyesight naturally

- Political correctness is really just herd psychology pushed by insecure people who desperately seek social conformity

- The REAL FAKE NEWS exposed: '97% of scientists agree on climate change' is an engineered hoax... here's what the media never told you

- Vaccine fraud exposed: Measles and mumps making a huge comeback because vaccines are designed to fail, say Merck virologists

- Spirulina truly is an exceptional food in every imaginable way

- Sugar takes on high fructose corn syrup in high stakes legal battle to see which is most unhealthy

- Beat cancer with 35% hydrogen peroxide

- A High-Carbohydrate Diet With Added Sugars Doubles Your Risk of Breast Cancer, Says New Research

- Natural remedies help lymphedema

- Measles vaccine far more dangerous than measles itself

- Forget Filling Cavities: Regrow Your Teeth Instead

- Eighteen Overlooked Symptoms of Adrenal Fatigue

- Synthetic vitamin C, or ascorbic acid, kills beneficial probiotic bacteria in the gut

- What's really in vaccines? Proof of MSG, formaldehyde, aluminum and mercury

- All-natural home remedies for dissolving painful kidney stones

- The best and worst forms of magnesium to take as a supplement

- Glyphosate disrupts DNA function, causing 'medical chaos' in the form of multiple diseases including Alzheimer's, Parkinson's, say researchers

- How to Detox Fluorides from Your Body

- Plastic surgeon sets patient on fire during breast augmentation procedure, then blames burn marks on allergic reaction

- Secrets of soil nutrition: Why the minerals in soil determine the success or failure of foods, health and civilization

- The REAL FAKE NEWS exposed: '97% of scientists agree on climate change' is an engineered hoax... here's what the media never told you

- Bullet proof immune system - how to not get a cold ever

- The best and worst forms of magnesium to take as a supplement

- The United Nations 2030 Agenda decoded: It's a blueprint for the global enslavement of humanity under the boot of corporate masters

- What's really in vaccines? Proof of MSG, formaldehyde, aluminum and mercury

- Vaccine fraud exposed: Measles and mumps making a huge comeback because vaccines are designed to fail, say Merck virologists

- Red Cabbage Found to Contain 36 Anti-Cancer Anthocyanins

- Forget Filling Cavities: Regrow Your Teeth Instead

- Beat cancer with 35% hydrogen peroxide

- The missing link - How to beat cancer with garlic

- Apricot Seeds Kill Cancer Cells without Side Effects

- Dandelion root far more effective in fighting cancer cells than chemotherapy

- Measles vaccine far more dangerous than measles itself

- HPV and Hepatitis B vaccines do not prevent cervical cancer and liver disease

- Oregon man convicted of collecting rainwater on his own property surrenders and begins serving 30-day jail sentence

- Prevent artery hardening and calcium buildup with aged garlic

- Six little-known natural remedies for tinnitus

- Early warning signs of cancer that cannot be ignored

- Newly released JFK files reveal Pentagon's role in creating Lyme disease and covid in the same lab

- Eleven days before Iran bombed Tel Aviv, my microscope revealed haunting images of EXACTLY what would happen

- Morphic resonance “remote viewing” reveals iconic Middle East images of stealth bombers, a falcon and a one-horned ram

- Mike Adams releases country western hit single: Goin’ Back in Time is Comin’ Home

- DECENTRALIZED SPIRITUALITY and the true teachings of Christ: Overcoming the censorship, threats and lies of organized religion to truly know God and the Universal Christ

- EPA advisor admits the agency is funneling billions to climate groups ahead of Trump’s return to White House

- HEALTH SECRETS: How to Instantly Block MSG Toxicity Using Natural Substances (and the secret of Methylene Blue)

- The Health Ranger releases “Vaccine Zombie” song and music video, using AI-animated zombies for the music video

- BOMBSHELL: Internal Pfizer documents exposed and reveal at least 16 PERCENT of their mRNA vaccine "adverse events" are REPRODUCTIVE DISORDERS

- Amazing microscopy photos reveal how freezing crystals attempt to mimic electronic structures they are touching

- The Coming Gold Revaluation: Strategic Financial Realignment in an Era of Dollar Collapse

- The AI Data Center Wars Have Begun… Farms, Water and Electricity is Stripped from Humans to Power the Machines

- Urgent Wake-Up Call: The Coming AI Robot Wars and the Great Human Unity

- BOMBSHELL: DNA testing kits are a SCAM to develop ethnic-specific bioweapons

- BOMBSHELL: Covid-19 mRNA nanoparticles EMIT LIGHT SIGNALS that communicate MAC addresses used for self-assembly inside the blood vessels

- The War on Light: How Governments and Big Pharma Keep You Sick By Blocking Healing Photons

- Aerosolized bioweapons? Strange “diploid biomasses” falling out of the sky in Florida captured under the microscope

- Doctors are still puzzled about “long vax,” a set of symptoms linked to COVID-19 vaccines

Science News & Studies

Medicine News and Information

Food News & Studies

Health News & Studies

Herbs News & Information

Pollution News & Studies

Cancer News & Studies

Climate News & Studies

Survival News & Information

Gear News & Information

News covering technology, stocks, hackers, and more

"Big Tech and mainstream media are constantly trying to silence the independent voices that dare to bring you the truth about toxic food ingredients, dangerous medications and the failed, fraudulent science of the profit-driven medical establishment.

Email is one of the best ways to make sure you stay informed, without the censorship of the tech giants (Google, Apple, Facebook, Twitter, YouTube, etc.). Stay informed and you'll even likely learn information that may help save your own life."

–The Health Ranger, Mike Adams